Verify IT Return through Aadhar: The Income Tax Department allows taxpayers to file ITR through both online and offline modes. Let us tell you that after filing ITR through online mode, it is mandatory to do ITR E-Verification. Today we will tell the complete steps that How to Verify IT Return through Aadhar OTP?

Verify IT Return through Aadhar:

After filing ITR through online mode, it is very important to do ITR E-Verification. Without verification, the return is considered incomplete and the return is canceled. Income Tax Department has given many ways to do ITR E-Verification, in which the method of ITR Verification through Aadhar OTP is very easy. So let’s know the complete steps of ITR verification through Aadhar OTP.

Complete steps of ITR verification Via Aadhar

If you want to e-verify ITR after filing it, you can use Aadhaar. ITR verification Via Aadhar is the easiest and safest way of E-Verification. You can verify your income tax return by following the steps given below.

Step 1- To verify income tax returns with Aadhaar, first of all, visit the website of the income tax department.

IT department Official website Link

Step 2- Now on the website of the IT department, go to ‘Quick Links on the left.

Step 3- Now click on the option of ‘e-File Return’ in the ‘Quick Links’ section given on the left side.

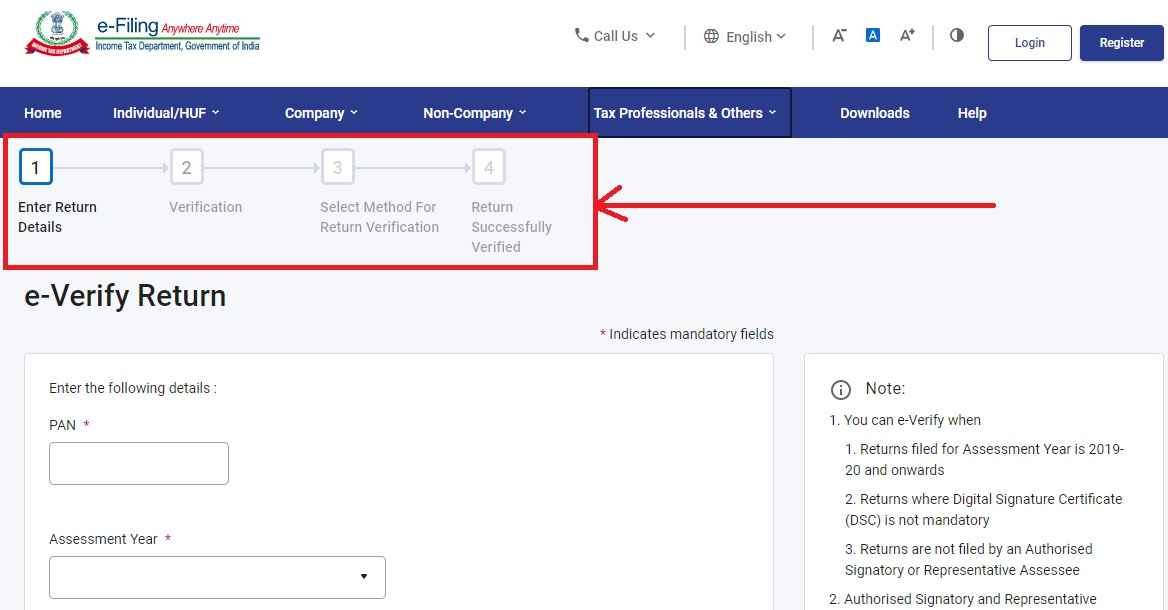

Step 4- After this, a new page will open. In which there will be complete steps of verification in front of you.

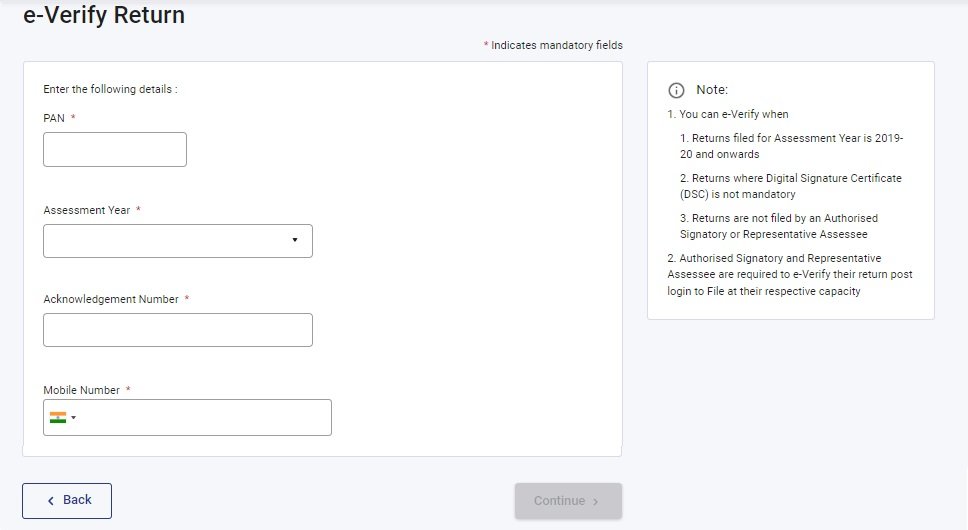

Step 5- Now proceed by entering PAN, Assessment Year, Mobile Number, and Acknowledgment Number in the e-Verify Return.

Step 6- After Enter Return Details, now two more segments will come: Verification Segment and Verification Method Segment.

Step 7- In the verification method, you must select the option ‘Return Verify through Aadhaar OTP’.

Step 8- In the ‘Aadhaar OTP option, OTP will be sent to the mobile number registered in your Aadhaar.

Step 9- After entering the OTP number, click on submit. After this, you will get the message of a successful return e-verified.

It is mandatory to link Aadhar with a PAN card

Giving information about e-verification of ITR, UIDAI has said that you can easily complete the process of e-verification through Aadhaar. For this, it is mandatory to link your Aadhar with a PAN card. Along with this, the registered mobile number must be entered into your Aadhar card.

#UpdateMobileInAadhaar

A simple method to e-verify your Income Tax Returns is by using your #Aadhaar. If your Aadhaar is linked with #PAN, you can e-verify your #ITR using Aadhaar. Please note that your mobile number must be registered in Aadhaar to avail of this service. pic.twitter.com/M2fpPwiMcR— Aadhaar (@UIDAI) May 25, 2022

e-verification deadline reduced!

Let us tell you that the IT department has reduced the time limit for e-verification from 120 days to 30 days after filing ITR. According to the new notification of CBDT, now the date of filing the return electronically will be deemed to be the same if Form ITR-V is submitted within 30 days from the date of transmission of data electronically. These rules have been applied to taxpayers who file their income tax returns on or after August 1.