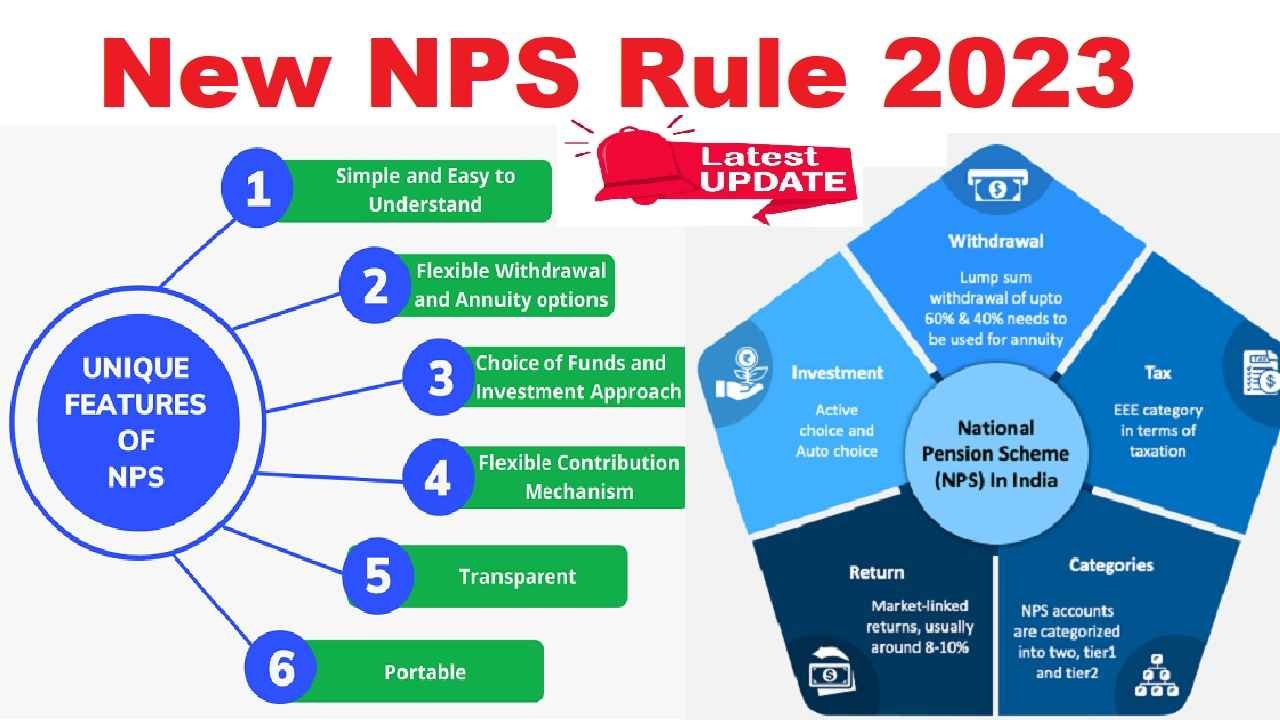

New NPS Rule 2023: There is big news for those investing in the National Pension System (NPS). Pension Fund Regulatory and Development Authority (PFRDA) has made a major change in the rules of NPS with effect from 1st April 2023. Let us know what are the new rules of NPS and which documents are mandatory to be uploaded.

New NPS Rule 2023:

To make the annuity payment faster and easier, PFRDA has made it mandatory for subscribers to upload the selected documents. Pension Fund Regulatory and Development Authority (PFRDA) has asked subscribers and nodal officers, POPs/Corporate to upload relevant CRA user interface documents. Let us know which documents are mandatory to be uploaded from 1st April 2023.

Documents required as per New NPS Rule:

All these documents will now have to be uploaded by those who want to receive annuity income from April 1, 2023.

1- NPS Exit/Withdrawal Form

2- Identity Froff and Specialization,

3- Address proof

7- Bank Account Proof

5- Copy of PAN Card

New rules will be applicable from April 1

According to the Pension Fund Regulatory and Development Authority (PFRDA), the New NPS Rule 2023 will come into force from April 1. As per the PFRDA circular, all nodal offices, and POPS, will explain to corporate customers the importance of uploading documents. Let us tell you that it takes several months to get a withdrawal and annuity from the National Pension System (NPS).

NPS Withdrawal Process To Be Easier!

These new rules will make the withdrawal process easier for NPS subscribers. Let us tell you that the NPS subscriber is currently required to use at least 40 percent of the total accumulated corpus to buy an annuity plan at the time of maturity. The remaining 60 percent of the NPS corpus can be withdrawn as a lump sum.

There is an additional tax exemption on NPS!

Investing in NPS gives the benefit of extra tax exemption of Rs 50,000 (NPS Benefits) under the National Pension System 80CCD (1B). Investing in the National Pension System is absolutely safe as it is supported by the Government of India.