Adani Hindenburg Report: After a negative report of Hindenburg, the shares of listed companies of Adani Group fell sharply. In one stroke, Gautam Adani’s net worth was about $ 6 billion (4,89,20,64, 00,000) cleared. Let us know what is the Hindenburg Report and what is the meaning of the fall in Adani’s shares.

Adani Hindenburg Report:

In the Hindenburg Report brought about by the Adani Group, questions have been raised on the loans of all the companies of the Adani Group. Andersen’s research report has claimed that 7 major companies of Adani Group which are listed in the stock market have more than 85 percent overvalues.

In the latest report of Hindenburg Research, 88 questions have been asked to the Adani Group. Gautam Adani’s wealth declined by $6 billion in a single day after the report came out. Let us know what questions have been raised by the forensic financial research firm Hindenburg in the Adani Hindenburg Report.

What are the 88 questions of Hindenburg?

Hindenburg wrote on Twitter that Adani Group has not answered any of the 88 direct questions raised in the report. Let us know which are the 88 questions of Hindenburg, that Adani Group is not able to answer.

- Why has Gautam Adani’s younger brother Rajesh Adani been made the MD of the group?

- According to Hindenburg, the above was accused of custom tax evasion, fake import documentation, and importing illegal coal.

- Hindenburg has asked Adani Group why Gautam Adani’s brother-in-law Samiro Vora has been made the Executive Director of the Adani Australia Division.

- According to the Hindenburg Research Agency, Samir Vora’s name came in the diamond trading scam.

We have included 88 questions in the conclusion of our report.

If Gautam Adani truly embraces transparency, as he claims, they should be easy questions to answer.

We look forward to Adani’s response.https://t.co/JkZFt60V7f

(55/end)

— Hindenburg Research (@HindenburgRes) January 25, 2023

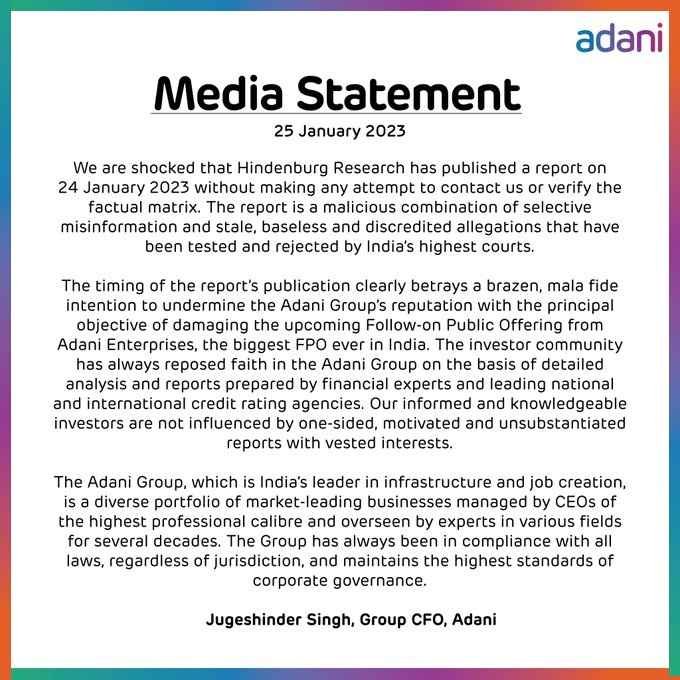

Adani Group rejects Hindenburg report

Adani Group has rejected the report published by Hindenburg Research on 24 January 2023, calling it malicious. Gautam Adani Group said that the report is a malicious combination of selective misinformation and stale, baseless, and defamatory allegations.

Gautam Adani Group said that this report has been prepared without any research. Post its publication, the sentiment of our shareholders and investors has been adversely affected.

Adani Group going to take action against Hindenburg

On January 26, the Adani Group issued a statement announcing punitive action against the research firm Hindenburg. The Adani Group said it is evaluating relevant provisions against the Hindenburg Research Agency under US and Indian laws.

Big drop in Gautam Adani’s wealth

Gautam Adani lost a huge amount of $6 billion in a single day after the report of the Hindenburg Research Agency came out. Due to this report Gautam Adani, the biggest tycoon in India and Asia, has suffered a loss of Rs 45 thousand crores. He has come in 7th place on the list of Forbes’ richest people.

According to the Bloomberg Billionaire Index, after this report, Adani’s net worth has now reduced to $113 billion and he has slipped from the fourth position to the seventh position on the list of the world’s richest people.

Big fall in shares of Adani Group

There is a big decline in the shares of Adani Group. On the other hand, in the last two trading days, the market value of Adani Group’s shares has decreased by Rs 2.37 lakh crore. The MCap of 10 Adani Group stocks fell 12 percent to Rs 16.83 lakh crore from Rs 19.20 lakh crore on January 24.

After the arrival of the report, the companies of Adani Group have been adversely affected. There has been a strong decline in the shares of all the companies of the Adani Group. On Wednesday, the shares of Adani’s companies took a dive of 6 to 7 percent. The process of decline in shares is still going on.

Full details of the Hindenburg Research Agency

Hindenburg Research was founded in 2017 by Nathan Anderson. The company is named after the 1937 Hindenburg airship crash that took place in Manchester Township, New Jersey, USA. It is written on the website of the firm that it monitors ‘Man-Made Disasters’.

Let us tell you that Hindenburg Research detects the disturbances happening in any company and then publishes a report about it. It is a forensic financial research firm that analyzes equity, credit, and derivatives.

Hindenburg Research focuses on factors such as accounting fraud, management lapses, and undisclosed related party transactions. It bets against the target company to earn profits.