Today we will know the complete step-by-step process that how to open Sukanya samriddhi account online in sbi. Along with this, we will know what qualifications are required to open a sukanya samriddhi account and what are documents required. In this post, we will also know about the major terms and conditions related to this scheme.

How to open sukanya samriddhi account online in sbi?

You can open a Sukanya Samriddhi account in any authorized bank branch or post office branch. But the advantage of opening a Sukanya Samriddhi account in the bank is that you can set up it online with the facility of net banking.

By opening an account in this scheme, you can deposit money little by little in the name of your daughter, which can prove to be helpful for her better future. Let us know step by step process that how to open sukanya samriddhi account online in sbi.

Complete Process to open Sukanya Samriddhi account online in sbi

Following is the step-by-step process to open a Sukanya Samriddhi Yojana account online at the State Bank of India.

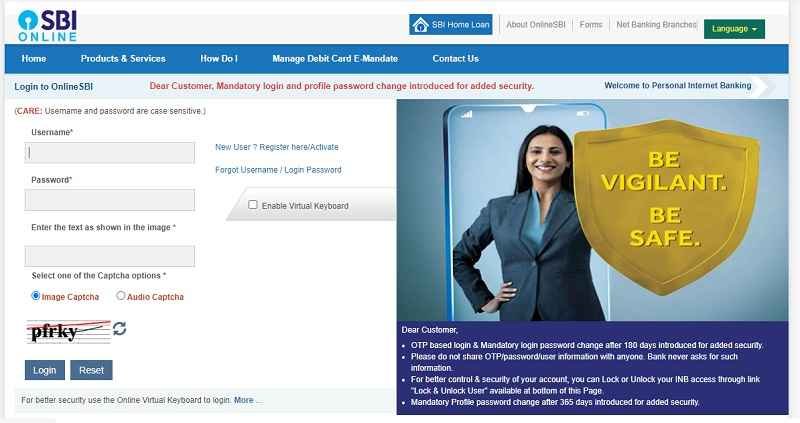

Step 1: First of all go to the website of the State bank of India (SBI).

Step 2: Now log in by entering your ID, Password, and Captcha.

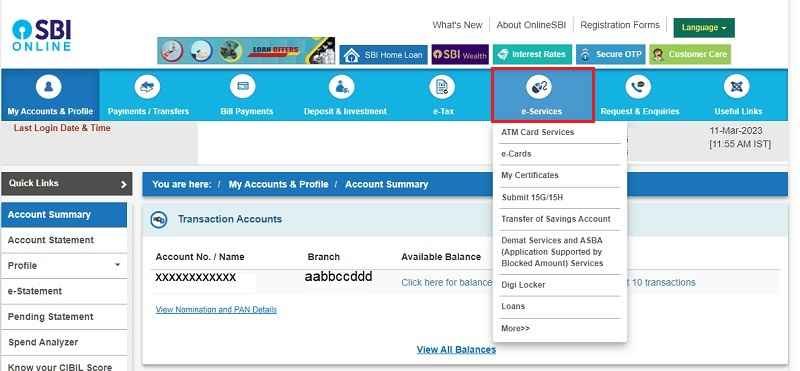

Step 3: Now click on the option of e-services.

Step 4: Now click on the option of “SSA Account Opening (by visiting Branch)” under e-Services.

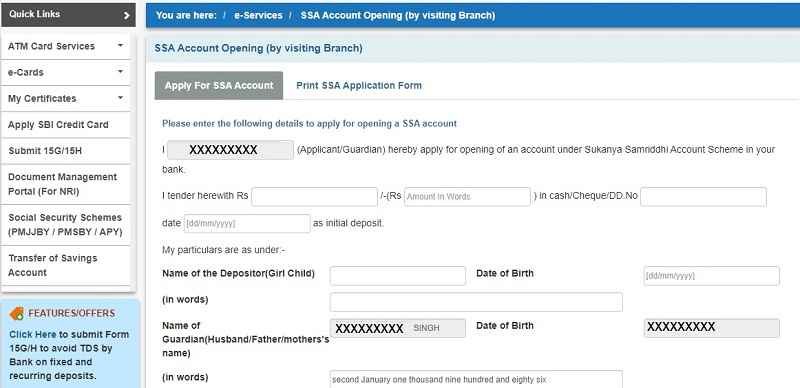

Step 5: Now an online form of Sukanya Samriddhi Yojana will open in front of you.

Step 6: Some of your details will already be filled in this online form if you are an SBI customer.

Step 7: Fill in other details of this form like “Name of the Depositor(Girl Child)” her birth certificate etc.

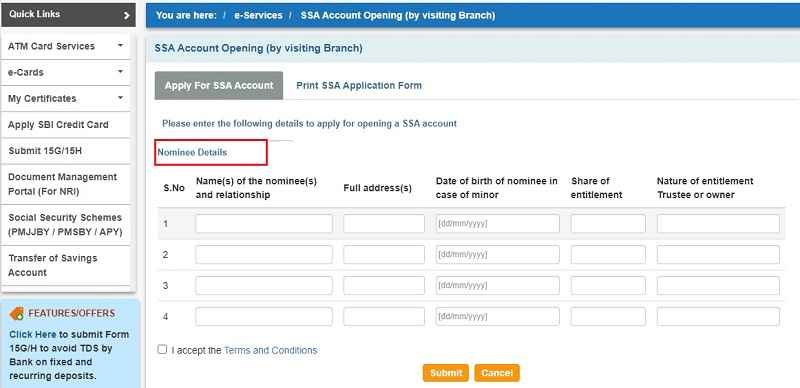

Step 8: Now fill in the details of the nominee in the last section of the form and click on the submit button.

Step 9: After submission, click on the option of “Print SSA Application Form”.

Step 10: Now take a printout of your SSA Application Form and submit it to your nearest branch within 30 days along with the required documents.

Step 11: Your account will be opened after inspection by the bank.

Documents required to open Sukanya Samriddhi Account

Following is the list of documents required to be attached to the form for opening the Sukanya Samriddhi account.

- birth certificate of the girl child

- 2 passport photos of the girl child

- 2 passport photos of the guardian

- parent’s identity card

- Guardian’s Address Proof Documents

How to deposit money online in the Sukanya Samriddhi account

Let us tell you that the bank in which you are opening Sukanya Samriddhi Account must have CBS (core banking solutions) system only then you can deposit money online. You can also deposit money in this account by cash, check, or demand draft. You can deposit money online in Sukanya Samriddhi Account in any branch of the State Bank of India.

What is Sukanya Samriddhi Yojana?

The Sukanya Samriddhi Yojana was started in 2015 under the Beti Bachao Beti Padhao campaign by the Government of India. The main objective of this scheme is to secure the future of girls. Under this scheme, parents or guardians can open a Sukanya Samriddhi account in the name of girls below the age of 10 years and deposit Rs 250/- to Rs 1.50 lakh per year in it.

Under this scheme, the account is opened for up to 21 years. In this, money had to be deposited for the initial 15 years. For six years, the account runs without depositing any money. This money deposited in the Sukanya Samriddhi account can be used in the future to meet the expenses of the girl child’s education and marriage.

Benefits of Sukanya Samriddhi Yojana:

The following are the benefits of the Sukanya Samriddhi Yojana.

- Sukanya is currently getting 7.6 percent interest annually.

- The interest is reviewed on a quarterly basis.

- Tax exemption is also available under section 80C of the Income Tax Act.

- Deposit, interest, and maturity amounts are all tax-free.

- You can claim tax exemption on a maximum of Rs 1.50 lakh.

Sukanya Samriddhi Account Maturity Period

The account of Sukanya Samriddhi Yojana matures in 21 years. You can invest in this scheme only for a girl child from 0 to 10 years. After the completion of 10 years of age, the daughter herself can operate her account.

When the age of the daughter is 18 years, then you can withdraw money from the account of Sukanya Samriddhi Yojana. Apart from this, you can withdraw 50 percent of the total amount for the daughter’s marriage. You will get the full amount only after 21 years.