5ers 25K Bootcamp, participants often complete assignments and challenges to demonstrate their knowledge and skills in live-market scenarios, working towards either improving their trading abilities or qualifying for funded trading accounts. Here are the 5ers 25K Bootcamp Trading Week assignment 3 Pre-Trade Checklist Answers.

Bootcamp Trading Week Assignment 3

The 5%ers’ 25K Bootcamp Trading Week is an intensive program designed to provide participants with real-world trading experience. It typically focuses on areas like risk management, technical analysis, and profitable trading strategies.

If you’re looking for Bootcamp Trading Week assignment 3, I can help with concepts or provide insights into technical analysis, strategy development, or any other relevant areas.

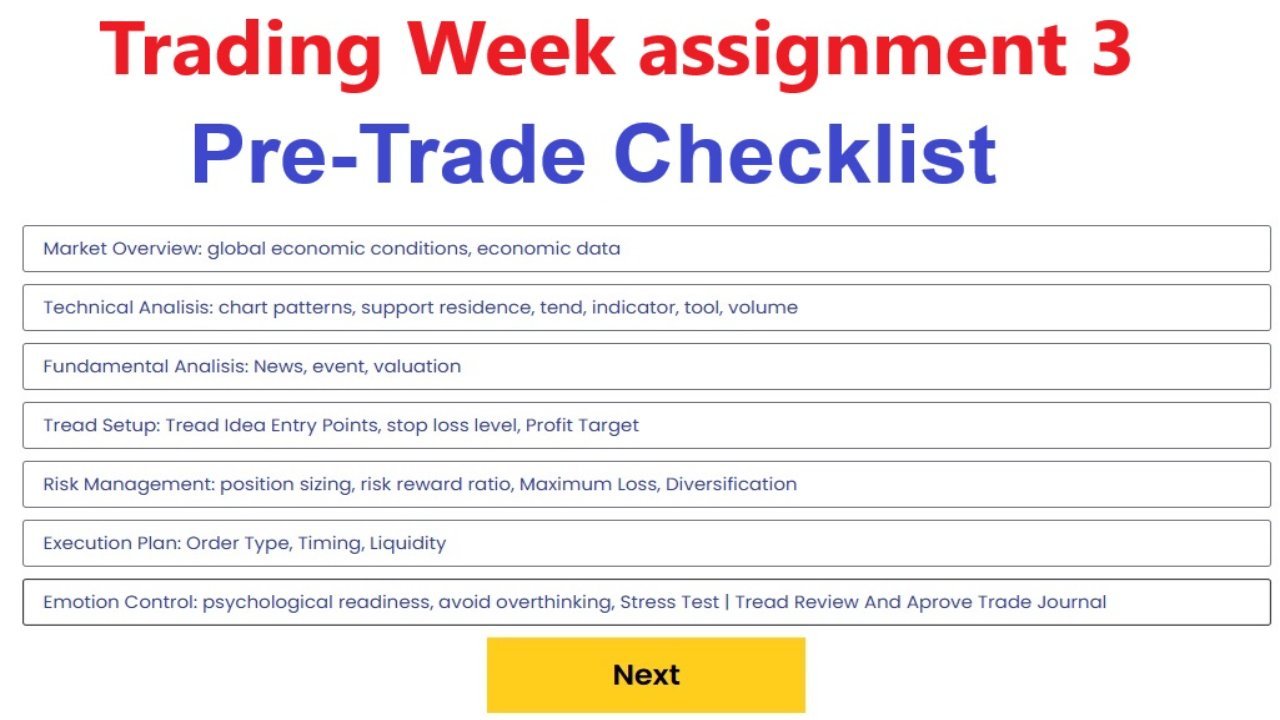

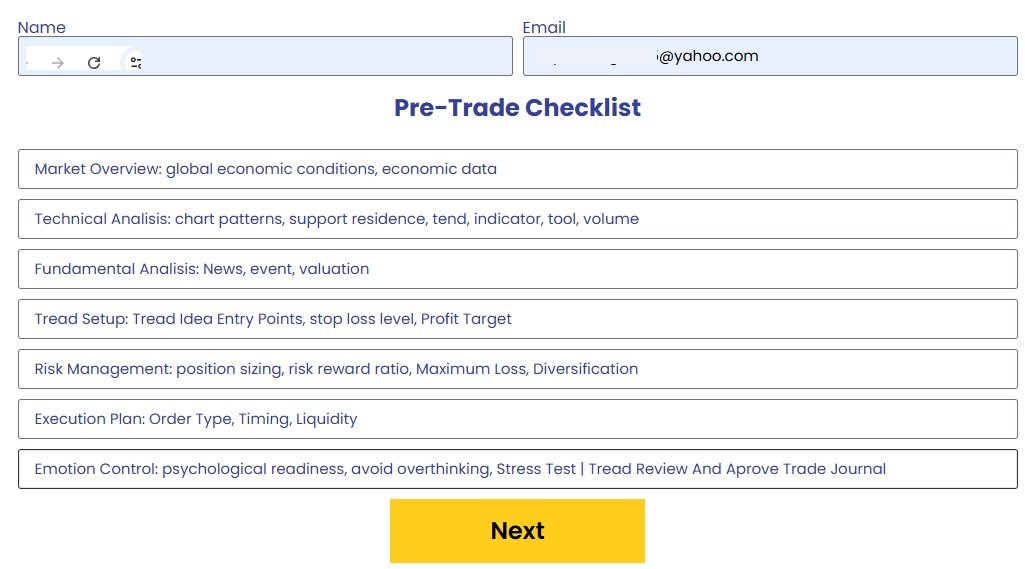

25K Bootcamp Trading Week Assignment 3 Pre-Trade Checklist Answers

Here are the 5ers 25K Bootcamp Trading Week assignment 3 Pre-Trade Checklist Answers.

Pre-Trade Checklist:

- Market Overview: global economic conditions, economic data

- Technical Analisis: chart patterns, support residence, tend, indicator, tool, volume

- Fundamental Analisis: News, event, valuation

- Tread Setup: Tread Idea Entry Points, stop loss level, Profit Target

- Risk Management: position sizing, risk reward ratio, Maximum Loss, Diversification

- Execution Plan: Order Type, Timing, Liquidity

- Emotion Control: psychological readiness, avoid overthinking, Stress Test | Review And Approve Trade Journal

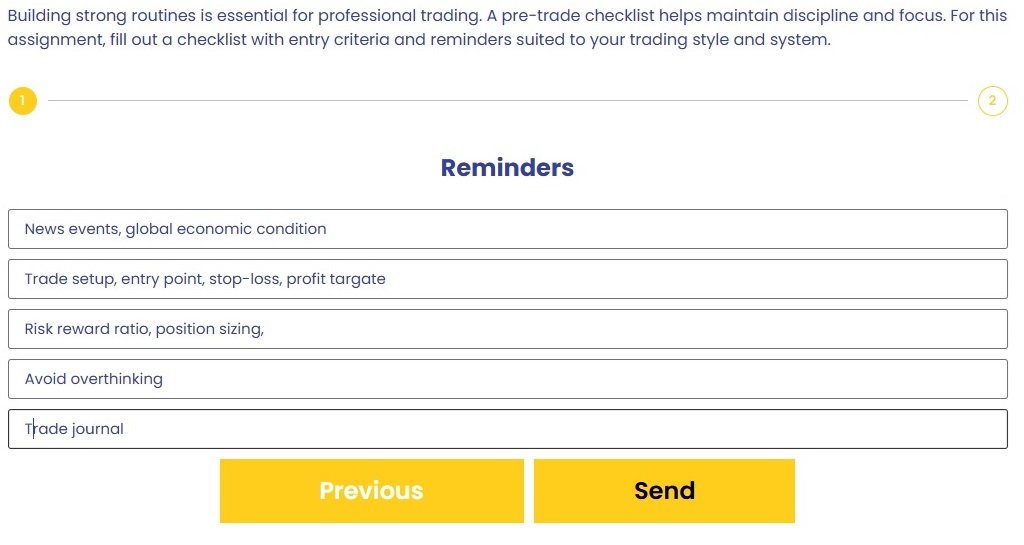

Reminders:

- News events, global economic condition

- trade setup, entry point, stop-loss, profit targeted

- risk reward ratio, position sizing,

- avoid overthinking

- trade journal

This bootcamp Program Covers the basics of trading, such as trading platforms, charting software, setting up accounts, setting stop-loss and take-profit levels, calculating risk-to-reward ratios, and using position sizing to manage risk effectively, and understanding common market terminologies.